Hammer Candlestick pattern

What is the hammer candlestick pattern?

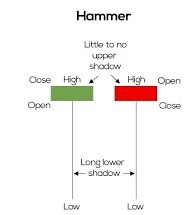

When the opening and closing prices are almost the same, it shows that the bulls have taken control of the prices. Since Hammer is a bullish reversal chandelier model, it should form at the end of a downtrend. The long shadow below shows that the bears initially pushed prices too low near the support. But then the bulls came along and eventually pushed the price higher and closed above the opening price. There is a difference between the hammer and the inverted hammer in terms of training. The inverted hammer candlestick is the inverted version of the hammer.

What does the hammer candlestick pattern tell you?

As seen above, Hammer forms after the stock price falls, indicating that prices are trying to bottom out. The hammers indicate that the bears have lost control of the prices, which suggests a possible reversal of the uptrend. It should be noted that this candle should form after 3 or more bearish candles as it gives more confirmation. Confirmation occurs when the post-hammer candlestick closes above the hammer close. This confirmation shows that the bullish return has occurred. Traders should only enter long positions after the confirmation candle. A stop loss can be placed at the bottom of the hammer shadow.

The Difference Between a Hammer Candlestick and a Doji.

A doji is another type of candlestick with a small real body. A doji means indication because it has both an upper shadow and a lower shadow. Dojis can signal a reversal in price or a continuation of the trend depending on the confirmation that follows. This differs from the hammer, which occurs after a price drop, indicating that a possible bullish reversal (if the confirmation path) has only a long lower shadow.

Limitations of Using Hammer Candlesticks

There is no guarantee that the price will continue to rise after the confirmation candle. A long gloomy hammer and a strong confirmation candle can push the price quite high in two periods. This may not be an ideal place to buy as the stop loss may be far from the entry point, exposing the trader to risk that the potential reward does not justify. Hammers also do not offer a target price, so it can be difficult to determine the profit potential of a hammer trade. The results should be based on other types of Japanese candlestick models or analysis read more.

Comments

Post a Comment