Morning Star

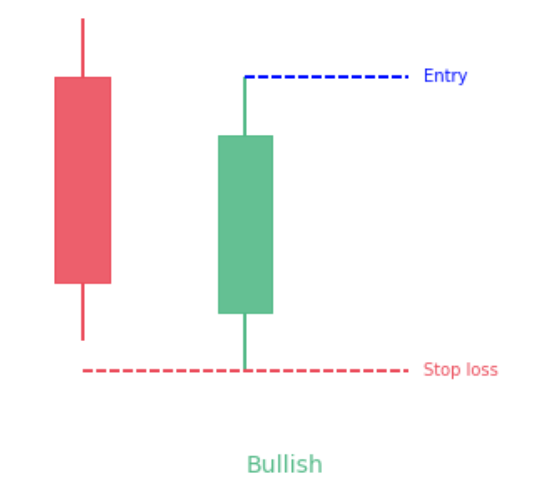

The Morning Star For the sake of simplicity, a bearish candlestick is one in which the stock's closing price is lower than its opening price, meaning that the price has fallen during the day. In contrast, a bullish candlestick is one where the closing price is higher than the opening price because the price has risen throughout the day. With that in mind, let us know as we take a closer look at the construction and key features of this popular candlestick pattern. What is the difference between Morning Star and Evening Star candlestick patterns? The main difference between the Morning Star and Evening Star candlestick patterns is that the Morning Star is considered a bullish indicator, while the Evening Star is considered a bearish indicator. The Evening Star has the center candle at a higher high than the two side candles with a gap up followed by a gap down, while the Morning Star has the center candle at its highest low with a gap down followed by a gap up. An example of a morn