PIERCING PATTERN

WHAT IS A PIERCING PATTERN?

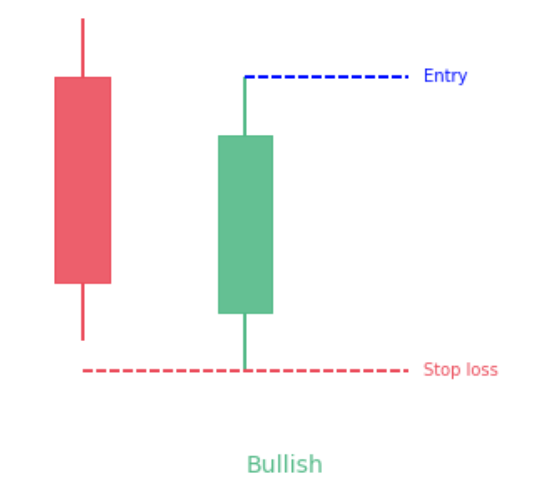

The piercing line pattern is considered a bullish reversal candlestick pattern at the bottom of a downtrend. This often results in a trend reversal when bulls enter the market and push prices higher. The piercing pattern features two candles, with the second bullish candle opening lower than the previous bearish candle. This is followed by buyers pushing prices past the 50% bearish candlestick body

.

How a Piercing Pattern Works

A piercing pattern has two days where the first day is decidedly influenced by sellers and the second day is answered by enthusiastic buyers. This may indicate that the supply of shares that market participants are looking to sell has dried up a bit and the price has fallen to a level where the demand to buy shares has increased and increased. This momentum appears to be a reasonably reliable indicator of a short-term bullish outlook.

How to identify Piercing Patterns?

First of all, it should be considered that the pattern formulation should consist of 2 candlesticks. The second candle must be such that it starts below the low of the day 1 candle (which is inherently bearish). At the same time, it should close at the top of the middle part of the bearish candlestick. When the bullish candle of day 2 closes above the middle of the bearish candle of day 1, it forms a triangle. Also, it only appears during a downtrend, and price gaps at the beginning of day 2 are necessary. The formation of this pattern is unique in that it shows the reverse trend of the market when its appearance has not been accepted.

It also includes a lower spread after the first trading day, with the second trading day starting around the low and ending near the high. The close must also be a candle that covers at least half the length of the previous day's red candle.

Advantages of using piercing pattern

This method is easy to use and implement. Any investor or trader can implement this technique. This method generally offers its investors a better risk/return ratio. By paying attention and understanding this technique, investors can easily find entry points into the stock or index.

Disadvantages of using piercing pattern

The main disadvantage of this method is that it can only be used for a bullish reversal pattern. And to confirm the reversal pattern, this technique should be combined with oscillators and other technical indicators. One cannot fully rely on this model when making trading decisions. This involves analyzing the entire market movement and not just the candlestick pattern itself read more.

Comments

Post a Comment